In recent months, iBuyers have been extremely effective marketing their unique selling method to homeowners in the Dallas real estate market. iBuyers or instant buyers are real estate investors who use an automated valuation model (AVM) to make quick cash offers to homeowners. These investors guarantee fast and stress-free closings that give sellers more control over their sale and moving dates. This is especially convenient for motivated sellers and those moving to distant or out-of-state locations. Opendoor, Offerpad, Redfin, and Zillow Offers are among the most well-known iBuyer companies operating in the Dallas area.

Statistics show that an increasing number of Dallas Fort Worth homeowners are gravitating towards the instant buying process. It has proven to be an extremely convenient and popular choice for the right kind of seller. Prior to the Covid-19 pandemic, instant home selling had increased by 25% in annual market share, over the last 6 years. In comparison to traditional brokerage companies, iBuyers provide a worry-free alternative similar to relocation companies that purchase employee homes and list their properties on the open market.

Real estate agents have a financial incentive to list properties at a fair market value; therefore, traditional broker fees range from 5% to 7%, with 3% going to the buyer’s agent and 1% to 4% charged to sellers for miscellaneous closing and listing fees. Sellers often invest time and money with repairs and/or updates in preparation for the open market. Despite these actions, a sale within a reasonable amount of time is not guaranteed—which can be stressful and problematic.

On the other hand, iBuyers purchase properties below market value to turn a profit and charge a “convenience fee” of 6% to 10%. Some also charge the seller upwards of 1% for fees typically paid by buyers at closing. Before making an offer, most instant buyers inspect the property and determine a mandatory home repair allowance that the seller pays at closing. Repair costs are deducted from the initial offer, which leaves the total direct costs ranging between 7% to 10%. Additionally, liquidity risks and capital costs must be factored in. iBuyers analyze market data for competing properties, average the time it takes to sell, and determine a competitive listing price. Inherent liquidity risks, capital costs, safeguarding vacant homes, and other adverse conditions generally result in a 3% to 5% markup, but unique houses, risky areas, and declining prices will cause the percentage estimates to fluctuate.

Comparing the two methods, a traditional real estate agent will cost around 5% to 7% versus an iBuyer which averages between 13% to 15%. Regarding costs, the favorable choice is a traditional agent; but to the right seller, the convenience of iBuyers may be worth it. Homeowners looking to sell should weigh the advantages and disadvantages of both options to determine the best method for their particular needs. I am available for anyone who wishes to discuss their options before making a final decision.

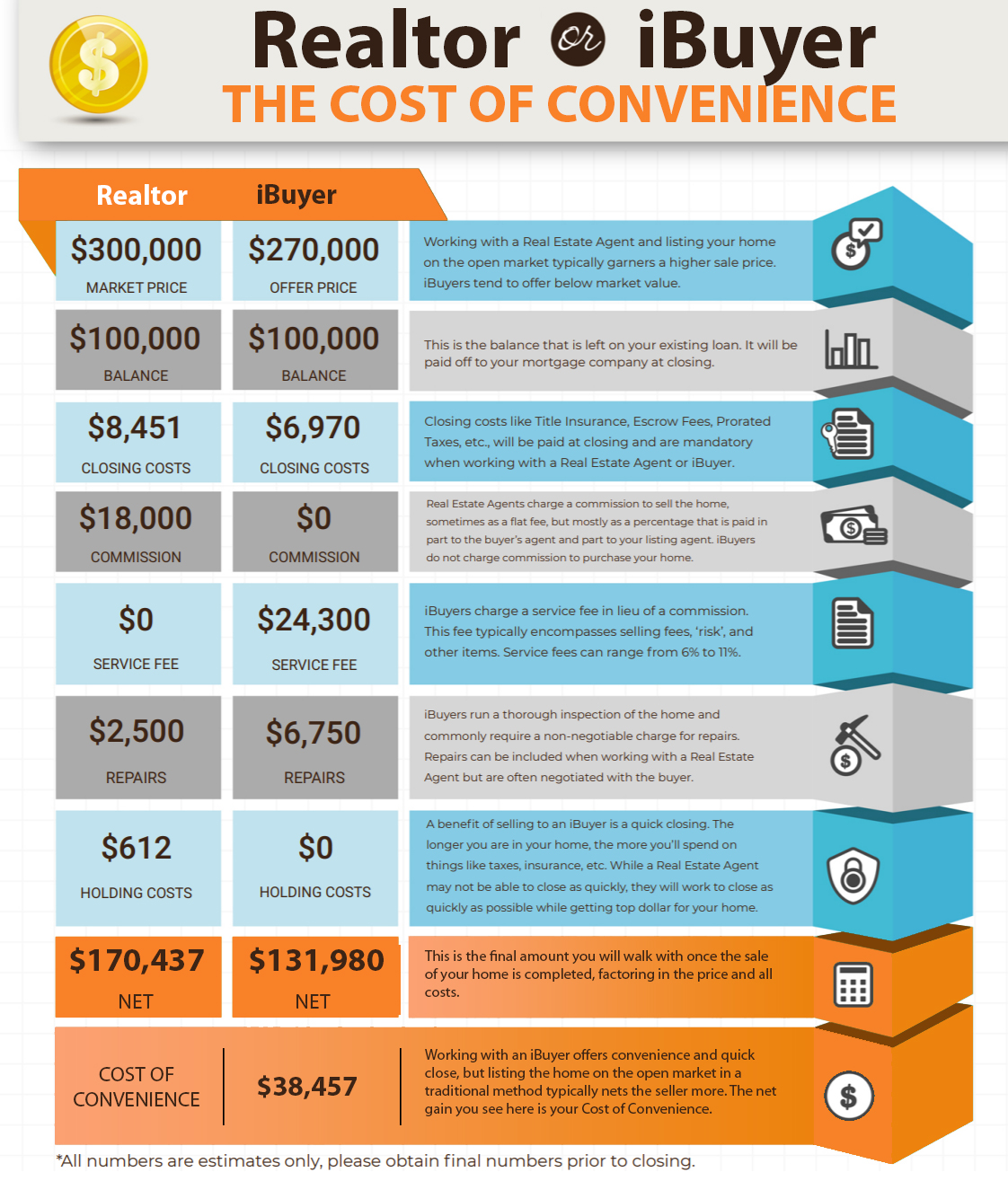

The following is a hypothetical illustration of the costs of convenience using an iBuyer for a $300,000 property.

Leave a Reply